Jungle Tax specializes in Virtual Finance Office (VFO) solutions designed exclusively for creative businesses. Whether you’re a design agency, film production house, or digital startup, our tailored financial services ensure your operations are streamlined, your decisions are data-driven, and your compliance is effortless.

Creative Industry Experts: Deep understanding of the unique financial challenges faced by creative ventures.

Cost-Effective Solutions: Save up to 50% compared to maintaining an in-house finance department.

Scalable Services: Flexible options that grow with your projects and business needs.

Advanced Tools: Leverage automation and technology tailored for the creative industry.

Regulatory Confidence: Stay compliant with all financial and tax regulations without stress.

Proactive Support: We anticipate challenges and offer solutions before they arise.

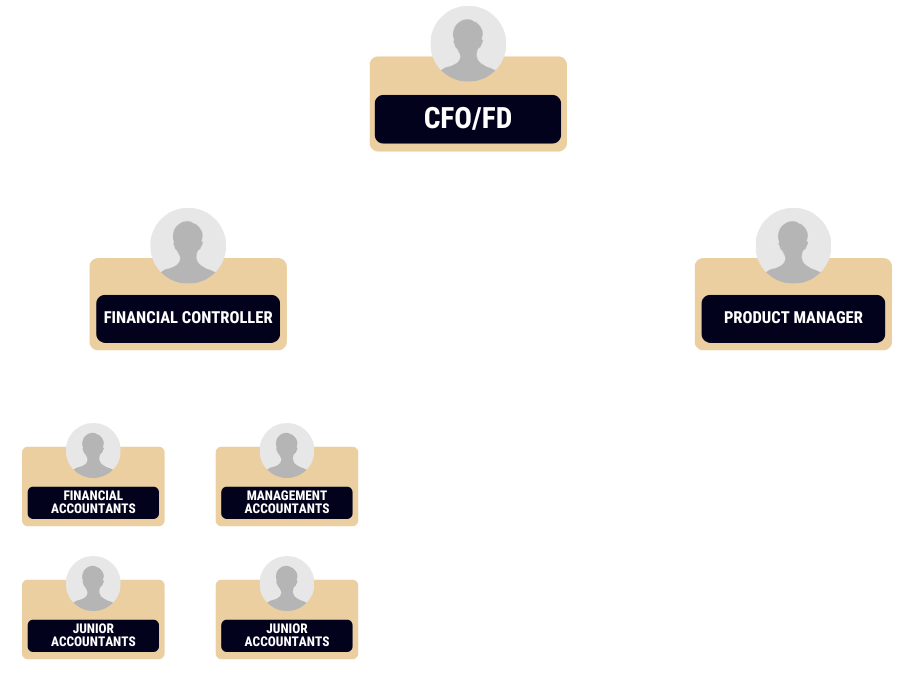

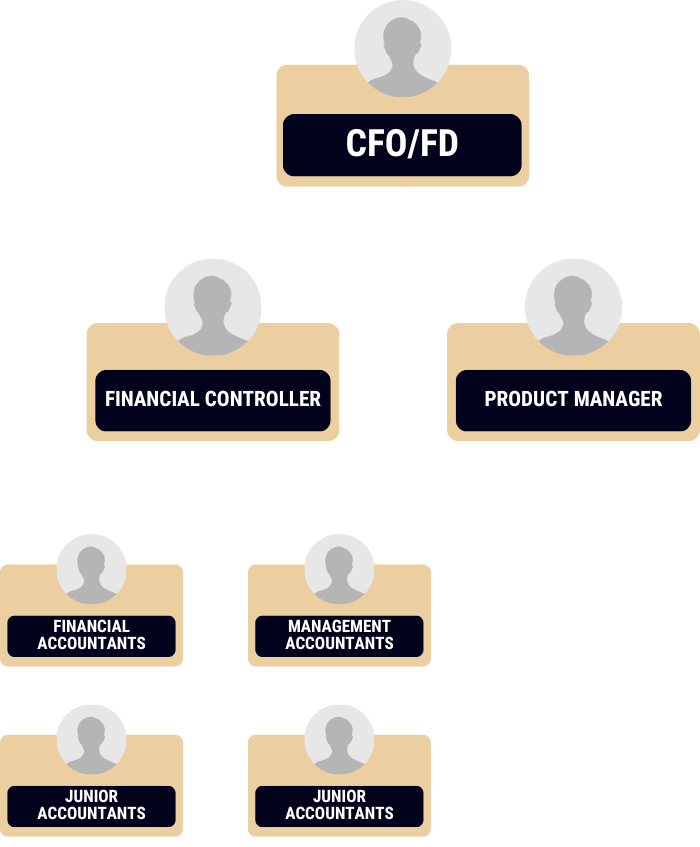

Jungle tax carry out all these roles for your business, so you can focus on what you do best!

We provide comprehensive financial support, encompassing all aspects of your business’s financial management, including services such as managing creditors’ payments and overseeing cash calls.

Jungle tax carry out all these roles for your business, so you can focus on what you do best!

We provide comprehensive financial support, encompassing all aspects of your business’s financial management, including services such as managing creditors’ payments and overseeing cash calls.

Creative Businesses Supported

Average Cost Savings Achieved

Reports Delivered Within 24 Hours

Compliance Accuracy

Funding Secured For Clients

Business owners often lack the specialized knowledge needed to handle complex financial tasks, such as compliance, forecasting, or tax optimization.

Hiring a full in-house finance team is expensive, especially for small or growing businesses.

Business owners often juggle multiple roles, leaving insufficient time to manage financial tasks effectively.

Rapidly growing businesses may find their existing financial systems inadequate to handle increased complexity.

Lack of accurate, timely financial data hinders effective decision-making and performance monitoring.

Non-compliance with tax laws and regulations can lead to fines, penalties, or reputational damage.

At Jungle Tax, our Virtual Finance Office (VFO) service is essential for businesses seeking expert financial management without the expense of a full in-house team. In today’s fast-paced environment, accurate financial insights and compliance are critical to staying competitive. Our VFO service handles bookkeeping, management accounts, cash flow forecasting, and tax compliance, providing real-time financial clarity and freeing you to focus on growth. With tailored solutions and cloud-based tools, we help you navigate financial challenges efficiently, ensuring your business remains agile, compliant, and ready for the future.

Director Obstacle Films Ltd

Jungle Tax made expanding our design agency to the US effortless! Their Virtual Finance Office services handled everything—finances, compliance, and forecasting—while we focused on growing creatively. Their expertise and support were key to making our international leap a success.

Director New Genre ltd

Jungle Tax has been amazing for our interior design agency! Their team made everything so easy—handling our bookkeeping, cash flow, and finances without any hassle. They’re always super helpful, quick to answer questions, and really felt like part of our team.

Director Caisley Ltd

Tax laws are complex and ever-changing, making it easy to miss out on key savings or fall out of compliance. Jungle Tax brings the expertise needed to navigate these challenges, ensuring your business stays compliant and takes full advantage of tax reliefs.

We specialise in identifying opportunities like R&D credits, Business Asset Disposal Relief, and Capital Allowances that many businesses overlook, potentially saving you significant amounts in taxes.

From handling cross-border tax to succession planning, Jungle Tax ensures you make tax-efficient decisions at every stage, allowing you to focus on growing your business.

Jungle Tax has been a game-changer for our film production! They handle everything—bookkeeping, payroll, cash flow, and tax advice—so we can focus on making movies. Their insights and support keep us stress-free and financially sharp. Highly recommend!