The Actor’s Financial Survival Guide: Smart Money Strategies from Jungle Tax

Financial Challenges Unique to Acting Careers The curtain may rise and fall, but financial pressures remain constant for actors. At Jungle...

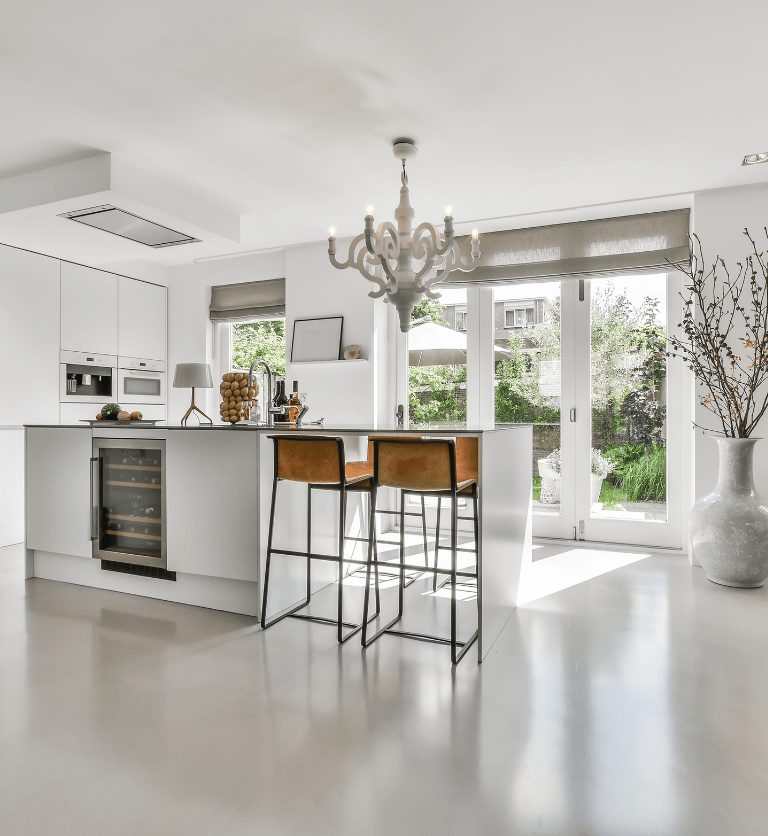

The UK real estate market is thriving, attracting local and international interest. As real estate accountants, we help clients capitalize on opportunities, from stunning homes to commercial spaces, with rock-solid financial strategies.

At Jungle Tax, we collaborate with real estate agents, developers, and investors to provide bespoke financial services that address the unique challenges of the market. We help clients manage property investments, navigate tax implications, and plan for future growth in a competitive landscape.

Our expertise goes beyond traditional accounting; we deliver insights that empower real estate professionals to make informed decisions. From managing rental income to optimizing property valuations, we handle the financial details so you can focus on closing deals.

Revenue generated by the UK real estate sector in 2023, reflecting a robust recovery in property transactions.

Source: UK Real Estate Market Report 2023

Increase in demand for rental properties in urban areas this year.

Source: Rental Market Insights 2023

Growth in real estate investments focused on sustainable developments in 2023.

Source: Sustainable Real Estate Report 2023

In real estate, every opportunity is an investment waiting to happen, and Jungle Tax is here to support your financial journey. Whether managing property portfolios, rental income, or investment strategies, we ensure your finances align with your goals.

As new opportunities arise—be it through property development or market expansion—we make sure your financial strategy remains strong, allowing you to focus on maximizing your investments.

— Jungle Tax Team | Real Estate Financial Experts

Financial Challenges Unique to Acting Careers The curtain may rise and fall, but financial pressures remain constant for actors. At Jungle...

As a musician, your world revolves around rhythm, creativity, and performance—not spreadsheets and tax codes. Yet money management can make...

The life of an artist is filled with passion, creativity, and unique financial challenges. Whether you're a painter, sculptor, digital...

As an actor, your career is built on talent, dedication, and the ability to adapt—but managing your finances shouldn’t require...

Jungle Tax Ltd, Registered in England 14589808, Registered Office: Office 31, Basepoint Business & Innovation Centre, Andover, England, SP10 3FG.

© 2025 Jungle Tax | Website by Wyld Gen