Creative Industry Tax Reliefs provide tax incentives for UK companies in sectors like film, animation, and theatre, offering additional deductions or tax credits on qualifying production costs to reduce their tax burden.

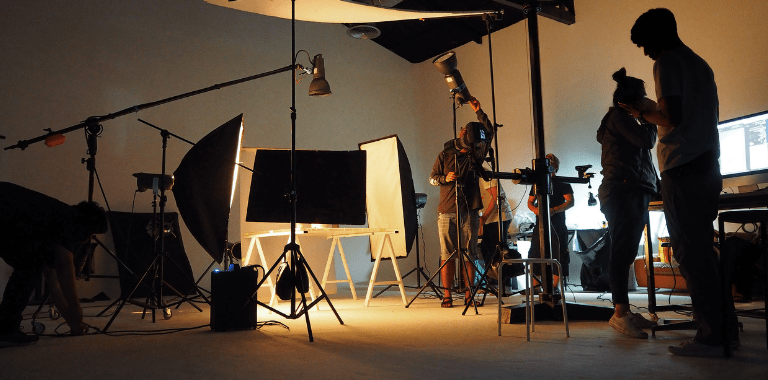

We collaborate with producers and companies in the film, TV, video game, and theatre industries at all stages of production in the UK. Our clients range from large international franchises to established independents and start-ups, and we provide tailored expertise for each.

Our focus is on helping clients secure financing and access all available Creative Industry Tax Reliefs (CITR). This includes audio-visual tax reliefs like the Audio-Visual Expenditure Credit (AVEC) for film and TV, the Independent Film Tax Credit (IFTC), the Video Games Expenditure Credit (VGEC), and cultural tax reliefs for theatre, orchestras, museums, and galleries.

Beyond advising on CITR eligibility and early-stage appraisals, we handle the entire CITR claims process with HMRC, ensuring all criteria are met and British Film Institute (BFI) certification is obtained. Recognised as leading experts in CITR, we have also influenced key policy reforms in this area, including the introduction of the Independent Film Tax Credit, while advising production companies and financiers on setting up in the UK.

To qualify for UK Film and TV Tax Relief, productions must be certified as British by the British Film Institute (BFI) and meet a minimum of 10% UK expenditure on core costs (pre-production, principal photography, and post-production). Films must be intended for theatrical release, while TV programmes must be broadcast-ready, including streaming services.

Specific reliefs include Film Tax Relief (FTR), which provides up to 25% of UK expenditure, High-End TV Relief (HETV) requiring an average core expenditure of £1 million per hour, and Animation Tax Relief (ATR), where at least 51% of core costs must relate to animation. Claims are made via the company’s Corporation Tax return with relevant certifications and cost breakdowns

To get certified as British by the British Film Institute (BFI), a production must either pass the cultural test or qualify through a co-production treaty. The cultural test assesses elements such as setting, characters, and the contribution to British culture, requiring a minimum score of 18 out of 35 points. The application can be submitted for either an interim certificate (before production ends) or a final certificate (after completion).

Applicants must provide a detailed application form with supporting documents, including a breakdown of costs and evidence of meeting the 10% UK expenditure requirement. Once reviewed, the BFI issues the certification, allowing the production to qualify for Film Tax Relief and other creative tax reliefs. More information is available on the BFI website.